Rising tide for international small cap value stocks? Following the long-lived outperformance of mega cap multinational stocks, we believe the recovery of international small cap and value stocks is sustainable. Read on for Metis CIO Machel Allen’s six reasons why we believe the shift in market leadership will continue.

News & Research Filed In:

Simmons has committed $10 million of its endowment to the Metis US Equity Index Fund, making it the first of the Founders Circle group of investors. The investment is part of the University’s commitment to advancing diversity, equity, and inclusion (DEI) and to addressing the systemic barriers that impede racial, social, and economic justice. Thank you to Simmons for your positive impact on Metis!

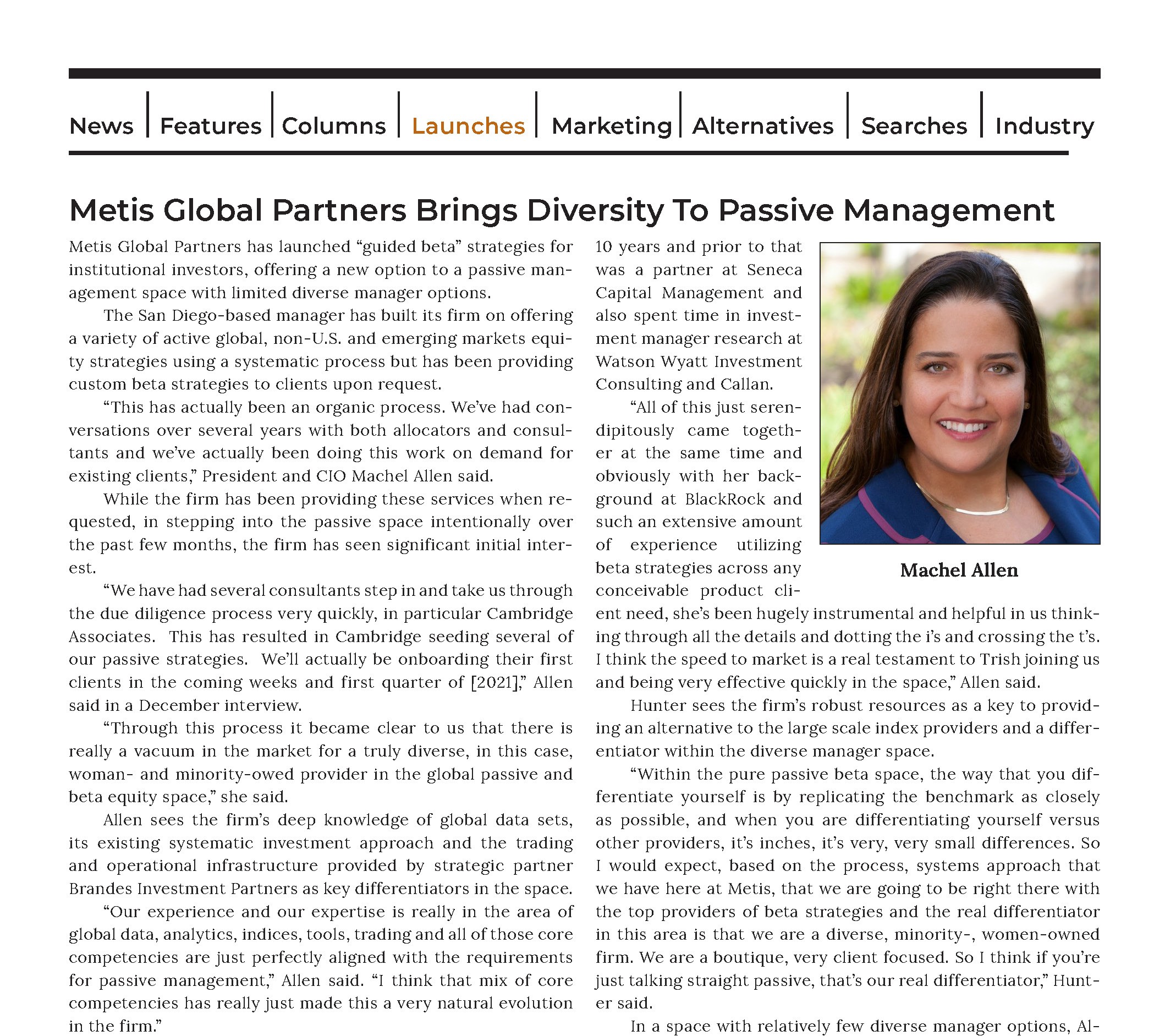

Metis Brings Diversity To Global Passive Management

Machel Allen is interviewed in the January 2021 edition of Emerging Manager Monthly to discuss Metis Global Partners’ launch of “guided beta” strategies for institutional investors.

Machel discusses her career path, some of the mentors and influencers who have shaped who she is as an investor, and her views on the future for diversity in the investment world.

Fifty Faces- Podcast- “Passion and Persistence” (and a few upset apple carts)

Machel Allen is President and Chief Investment Officer of Metis Global Partners, a firm she founded in November 2013. The firm, based in San Diego, is focused on global equity investment across the size spectrum from micro-cap to large cap. She previously spent time as an equity and research analyst at a range of asset management firms. Our conversation covers the entry level roles that revealed to Machel the opportunity to develop a proprietary investment process, and the fragments of inefficiencies that she loves about the investment world. Her persistence in setting up her own firm and building it in a sometimes tough asset raising environment are testament to her tremendous grit, but as we discuss, Michel has been upsetting apple carts for most of her life. We will hear why she is optimistic about the future for diversity in the investment world, and some of the mentors and influencers that have shaped who she is as an investor.

Recorded October 27, 2020

https://www.listennotes.com/podcasts/the-fiftyfaces/32-machel-allen-passion-and-RgekH2qfDAn/

Watch as Metis Founder and CIO Machel Allen leads the discussion on the CFA Institute’s first global conversation regarding race and inclusion in the asset management industry. Joined by pioneer and founder of Ariel Investments, John Rogers and Wharton University Professor of Identity and Diversity, Stephanie Creary, this global webcast frames the structural issues of race in the industry and asks the questions: “What should our actions be to confront racism in the investment industry? As responsible investment professionals, what steps can we take as individuals? What commitment to racial inclusion should we expect from our organizations?

Recorded July 2, 2020

https://www.cfainstitute.org/en/research/multimedia/2020/race-and-inclusion-now

Machel Allen, CFA discusses her experience leading an asset management firm during the COVID-19 crisis and shares her view that now, more than ever, is the time to have a robust, and thus diverse, decision-making apparatus in place. Machel explains how firms that embrace diversity will have an opportunity to differentiate themselves during these turbulent times.

The Home Front speaker series captures the responses of leading thinkers to the current COVID-19 crisis. Speaking from their homes, these experts share their insights across economic, social, and pollical realms.

Recorded May 8, 2020

https://www.cfainstitute.org/en/research/multimedia/2020/home-front-machal-allen

Metis President and Founder Machel Allen continues to receive questions from clients and consultants on the same topic: “should we abandon small cap stocks?” and “are small cap value stocks a thing of the past?”. Read more on how Machel responds to these queries, and the historical observations that power her response.

Many investors seek out Emerging Markets (“EM”) for long term opportunities. But the notorious volatility of EM can provide a rough ride in the short-term. The good news from a value perspective is that periodically volatility can provide entry point opportunities with the potential to boost long-term returns substantially. Read more on Metis’ views regarding… Read the abstract

Analysis of market and company fundamentals shows that international small cap value stocks may be poised to benefit from changes in underlying macro-economic conditions, historically cheap valuations, and defensive company attributes. Read more on the potential opportunity Metis sees unfolding.