Integrating Global Micro-Caps In Your Portfolios

Our previous report on Global Micro-Cap stocks published in conjunction with the Brandes Institute, “The Next Best Thing Could Be Really Small: An Introduction to Global Micro-Cap Stocks” explored characteristics and potential benefits of global micro cap stocks. The return and diversification potential of this asset class by way of access to a vast and inefficient segment of global markets may represent a compelling opportunity for institutional investors. At the paper’s conclusion, however, investors might be left wondering how they can integrate global micro caps into their portfolios. Working alongside the Brandes Institute once again, we explore various options investors might want to consider.

- Extending Existing Equity Allocations through Global Micro-Caps may:

- Add exposure down the market cap and out the geographic spectrum to fill in commonly overlooked areas of global markets.

- Complement or replace existing satellite exposures for those adopting a core-satellite framework for asset allocation.

- Complementing Alternatives Allocations with Global Micro-Caps may provide:

- Similar attributes to private equity, as buyout funds often target micro caps while other micro caps represent a “post-venture capital” progression of a growing business.

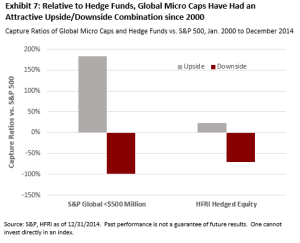

- Hedge fund-like characteristics with better upside participation, creating an opportunity to pair the upside/downside benefits of both asset classes.

An optimal implementation solution for adding global micro-caps can vary by investor, whether it is direct investments or exposure through fund-of-funds offerings. As with adding any new asset class, due diligence is required to investigate risks and concerns, including costs, liquidity, transparency, and custody.

To learn more about the potential benefits and options for adding global micro-cap stocks to your portfolio, read the Brandes Institute’s complete report The Next Big Thing Could Be Really Small: Integrating Global Micro-Caps In Your Portfolios